Why Is Northern Virginia Such A Hot Data Center Market?

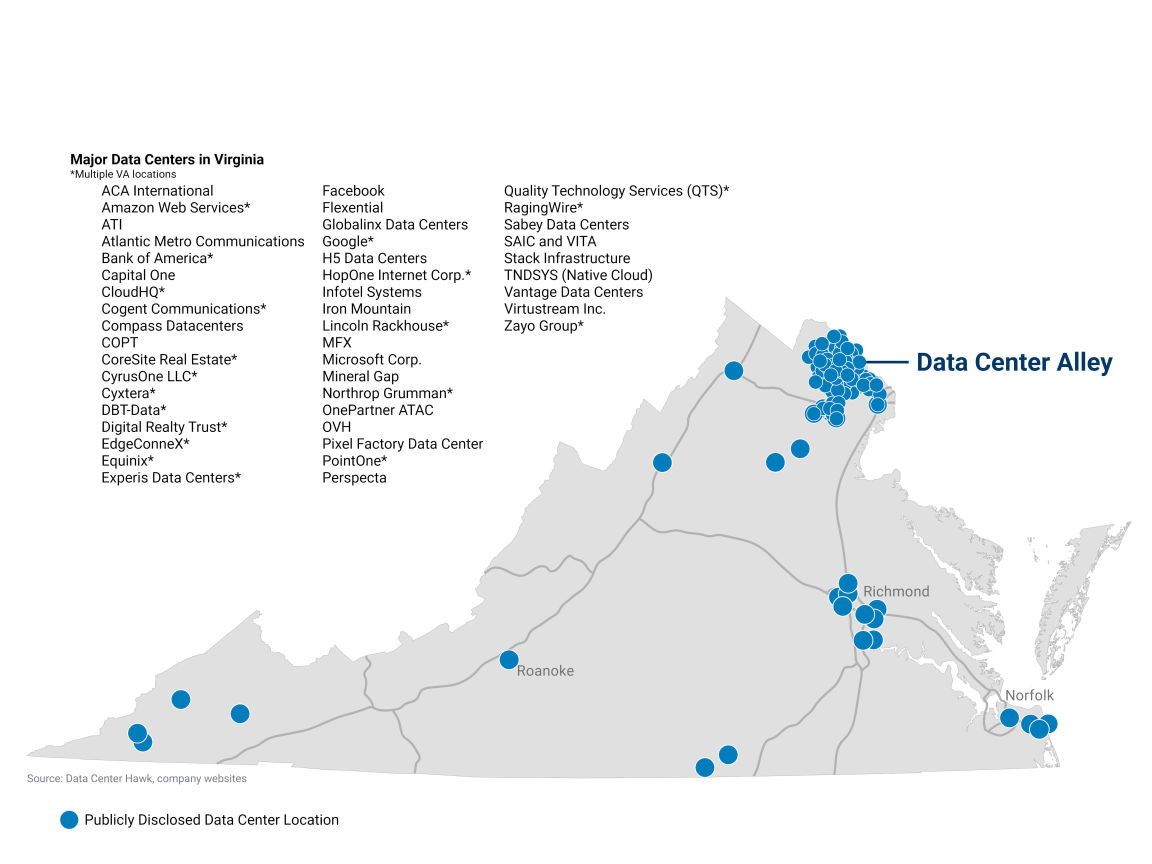

Just outside of Washington D.C., a new kind of capital has been developing in Northern Virginia (NoVA). Through decades of innovation, government incentive, and private sector investment, NoVA's Fairfax and Loudoun counties accept become habitation to Data Center Alley, the internet capital of the earth.

What is Information Center Alley?

Data Heart Aisle is dwelling to a cluster of data centers, businesses, and government organizations in Ashburn, Virginia. This area is besides known as the Dulles Technology Corridor due to its proximity to the Dulles International Airdrome (airport code IAD, not to be confused with DIA). Information Center Aisle spans beyond the Fairfax and Loudoun counties in VA, just its infrastructure is utilized all around the earth; an estimated 70% of the world's net traffic travels through Information Middle Alley each day.

Photo Source: VEDP.org

Equally of 2020, Data Center Alley is dwelling to over 12 1000000 foursquare feet of commissioned information center space with over 800 megawatts of power. Companies with a presence in Information Eye Alley include providers such equally Equinix, the largest data middle colocation provider in the world, as well as "hyperscale" public cloud companies who use a mix of self-built/bought data centers and leased third party colocation data centers.

Merely what is drawing all of these companies to Information Center Alley for their data centre and colocation needs in the first place?

A Brief History

Many people don't know that "the cyberspace" existed prior to the 1980's. One of the earliest internet exchange points was funded by the Advanced Enquiry Projects Agency (ARPA), a U.S. regime bureau based in Arlington, Virginia. ARPA developed the commencement interconnected packet sharing network in the late 1960s, known as ARPANET. Originally developed to facilitate advice betwixt Pentagon funded research institutions and universities, ARPANET later transformed into the network of networks that would go the internet. Arlington's early on achievements in network connectivity laid the groundwork for what was to come up in Virginia.

Momentum in the Northern Virginia data center community began in the 1990s when fundamental players such as AOL and Equinix added locations in the surface area. Merely Data Center Alley's reputation as a prime location for data centers and colocation was ultimately solidified when the Metropolitan Expanse Commutation-E (MAE-East), one of the first large cyberspace peering exchanges, was relocated to NoVA in 1998. The relocation of MAE-East meant that a majority of the earth's internet traffic was now flowing through Data Center Alley. The road to relevance was not a straight line for Information Eye Alley, however. The dot-com chimera in the early 2000s cast purpose-built internet data centers to the shadows, as overcapacity caused investors to fear that "if you lot build it, they might not come up".

Since the dot-com bubble, a new boom in data center structure has taken place due to increased server space demand. This growth in demand has been led past digitization, cloud migration and legislation, besides as a trend towards information center outsourcing. Data Middle Alley significantly benefited from these trends thank you to its predetermined reputation and importance in the data center manufacture.

What's and then special about Data Center Alley, anyways?

The substantial network of data center and cloud service providers has created an irreplicable ecosystem in Information Center Alley, solidified by the characteristics outlined beneath:

-

Power: A pregnant amount of energy is required to keep your network running and maintain an optimal climate for the IT equipment. The typical price per megawatt paid by information centers in Information Center Alley is 28% lower than national boilerplate, due to admission to Rule Virginia Power as well as the Potomac River for server cooling needs.

-

Cobweb: Data Center Aisle has admission to countless redundant fiber optic loops (terrestrial in NoVA and subsea in Virginia Embankment) and cross connect opportunities that provide access to businesses and ISPs throughout the region. A robust fiber network offers compounding network effects due to improved connectivity, redundancy, and disaster recovery options.

-

Supportive Government: The State of Virginia was a showtime mover in pro-data heart legislation and policy; when VA enacted its first data center tax exemption in 2009, simply seven other states offered like incentives, while today over 30 states offering these incentives. Such incentives include a 6% sales and utilize tax exemption (on servers, generators, chillers and server-related equipment) and tax deductibility of recruitment and training cost for new job creation.

-

Competent Workforce: Information Center Alley benefits from a talented workforce due to its proximity to Washington D.C. and the highly educated population of the region. In fact, over lx.0% of Loudoun canton'due south population has a bachelor'southward degree vs. a national average of 36.0%. Additionally, Northern Virginia was ranked #two for the acme technology talent markets in a 2020 CBRE survey.

-

Space to Build: While the Information Center Aisle real estate market has been hot, commercial country available for development still exists in the area.

-

Safe Location: Data Centre Alley is in a location that does not feel adverse weather condition or natural disasters, providing a reliable ecosystem for data centers.

-

Resources: NoVA is healthily populated with data center equipment and other resources providers.

An aerial view of major facilities in Data Center Alley in Ashburn, Virginia. Photo Source: ArcGIS.

Recent Trends in Information Center Alley

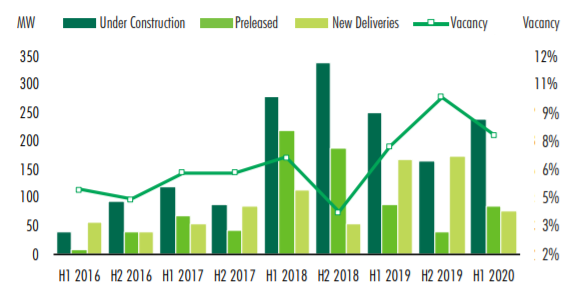

2020 saw record data centre demand as the COVID-xix pandemic required millions of people to work and attend school from domicile which, in turn, accelerated the tendency towards e-commerce and online entertainment. According to Due north American Information Centers, Multi-Tenant Information Eye (MTDC) leasing of ~700 megawatts in 2020 was an all-time tape, clocking in at 3x greater than 2019 and 2x over 2018 demand. Northern Virginia was the leading region, leasing more than 500 megawatts: 80% of the total for United states & Canada in 2020.

Over the final year, we've identified these peak trends in Data Center Alley:

-

Continued Shift to Hybrid Connectivity Models: Enterprises continue to shift from on-premise data centers to colocation and outsourced public cloud providers, driving demand for Data Center Aisle. This trend accelerated in 2020 as companies worked to fulfil the Information technology requirements of a remote workforce. Gartner estimates that by 2025, 85% of infrastructure strategies will integrate on-bounds, colocation, cloud and edge delivery options, versus just twenty% in 2020.

Photo Source: Mordor Intelligence

-

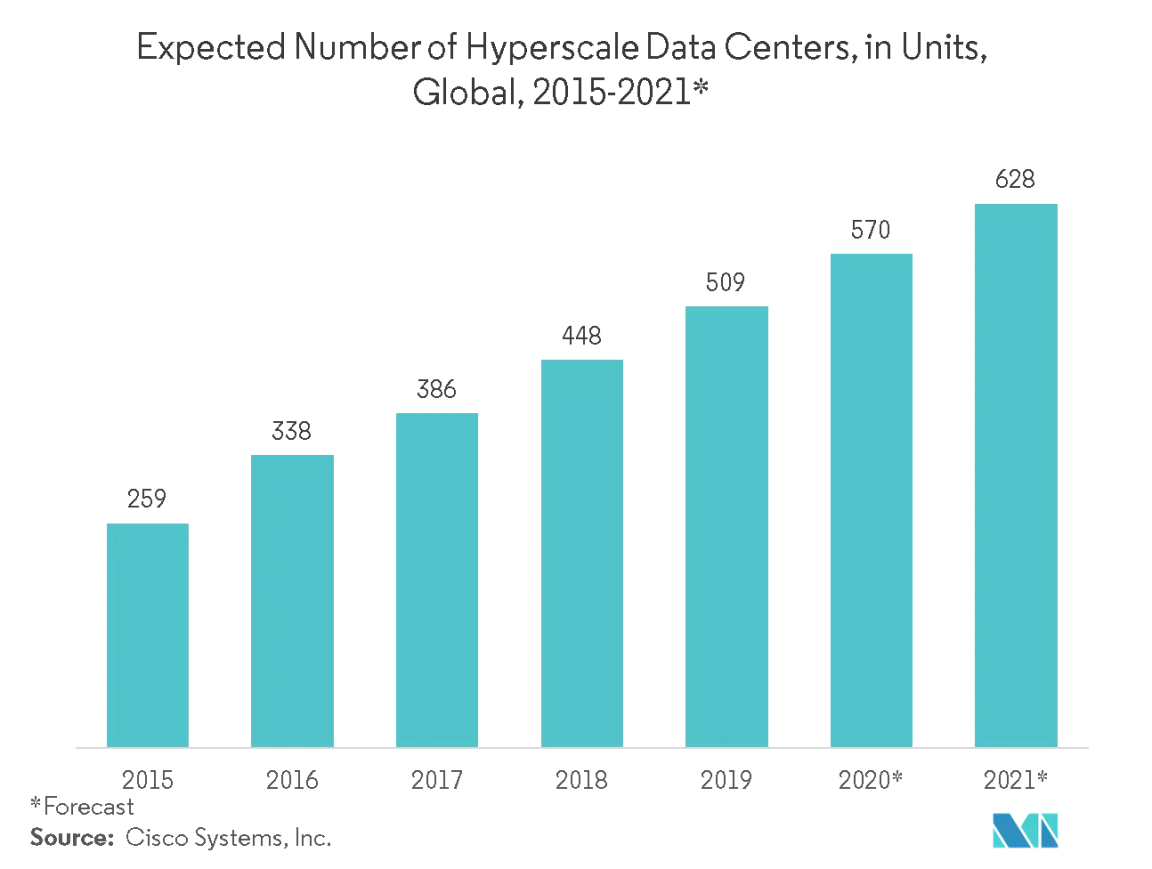

Hyperscalers: Hyperscalers such as Amazon Web Services and Microsoft Azure have led the accuse in 2020 data eye demand, as they require more capacity to service the widespread shift to online activity. For example, Amazon spent $73 million on 100 acres in Virginia in January 2020 and afterwards announced plans to fast track construction on iii more than information centers as well.

Historical Northern Virginia Data Heart Market Information. Source: CBRE Research , CBRE Data Middle Solutions, H1 2020

-

Constrained Supply Augmented past New Construction: COVID-xix driven demand in 2020 absorbed the supply of information center infinite in NoVA, resulting in a structure blast.

-

Robust M&A and Investment Activeness: Data eye M&A in 2020 was record setting and Data Center Aisle benefitted from the increased investor interest. Investors pay $2.0 million+ per acre in Data Centre Alley due to its supreme information center ecosystem and connectivity opportunities.

Dominion Energy has announced plans to develop multiple utility calibration solar projects in Virginia. (Photo: Rule Free energy )

-

Continued Demand for Green Energy: Data Center Alley customers and a newly democratic bulk regime in Virginia connected to push for green data center energy in 2020. Dominion Energy has outlined several initiatives to aid come across the need.

-

Pre-Leasing: To avoid overbuilding, many data center providers pre-lease information centre space that is under structure. Many existing customers have a right-of-first-offer (ROFO) on the infinite, making it harder for new customers to enter an ecosystem.

What's next for Information Center Alley?

While the COVID-19 pandemic led to a surprise surge in data centre need in 2020, we expect the underlying trends in Data Centre Alley to continue beyond the pandemic. The new normalcy of piece of work from dwelling practices, continued growth in hybrid Information technology solutions, also every bit a pro-technology VA regime will continue to support the healthy data center surround in Northern Virginia. Looking forward, nosotros await emerging trends such as AI, IoT and VR/AR to bulldoze data middle demand while also revolutionizing operations.

Interested in implementing a individual or public deject solution for your business? Lightyear will source quotes and manage implementation on your behalf. Click here to get started.

Did you enjoy this blog? You should check out our Dedicated Internet Access Pricing Guide, Broad Area Networking Pricing Guide, and SD-WAN Buyers Guide, if you haven't already!

Why Is Northern Virginia Such A Hot Data Center Market?,

Source: https://lightyear.ai/blogs/ashburn-colocation-data-center-alley

Posted by: wagnersubbillson.blogspot.com

0 Response to "Why Is Northern Virginia Such A Hot Data Center Market?"

Post a Comment